Selling USDT (Tether) or any other crypto has become extremely common in India through OTC desks, P2P platforms, and private buyers. However, with rising demand, USDT selling scams in India have also increased sharply.

Many crypto users lose lakhs or even crores—not because they lack technical knowledge, but because they ignore early warning signs. There are regular stories of USDT Scam can be read on dedicated crypto community on Reddit platform shared by users.

If you are planning to sell USDT & other cryptos, especially in large volumes, this guide will help you identify scam tactics and protect your funds.

Why USDT & other cryptos, Selling Scams Are Increasing in India ?

India’s crypto market has seen:

- High taxation on exchanges. ie. 30% Crypto tax

- Banking restrictions. ie. Too many Bank Account freeze

- Increased demand for Offline USDT & other cryptos trading solution.

This has pushed many users toward informal buyers, where scams are more frequent.

Understanding these red flags can save your money, time, and legal trouble.

11 Red Flags to Avoid Scams While Selling Your USDT –

1. Offering Unrealistic Rates (₹100+ per USDT)

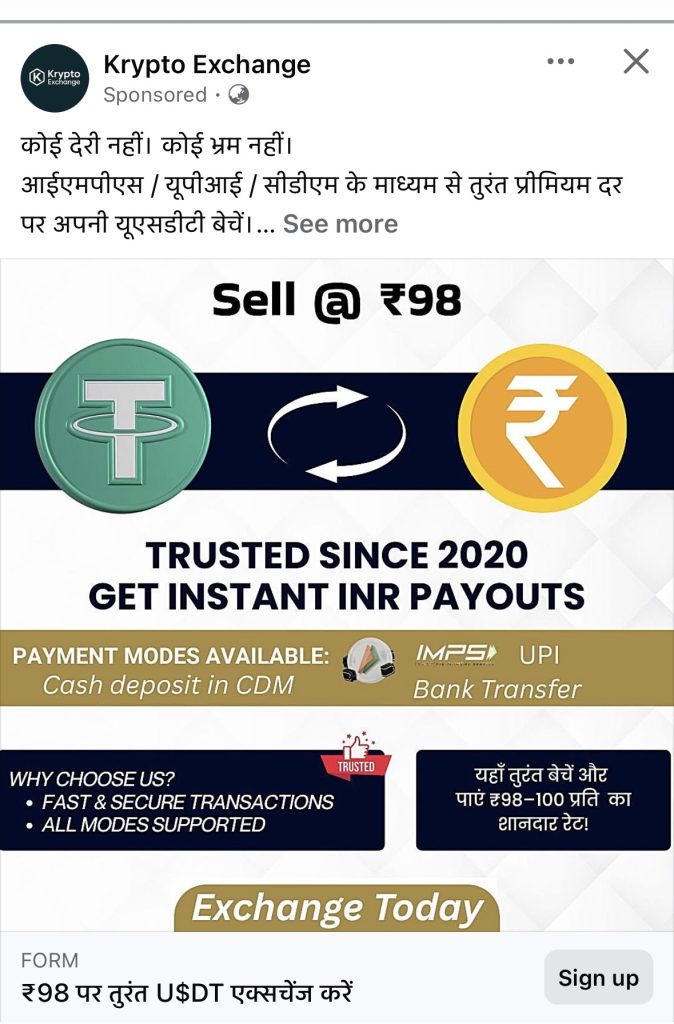

You might have seen many ads on Facebook/Instagram like above claiming to give you rate of ₹100 or more per USDT. If someone is offering you ₹100 or more per USDT when the market rate is clearly much lower, that is your first and biggest red flag.

Scammers use greed as bait.

No genuine buyer will consistently pay far above market price without a solid commercial reason. High rates are often used to:

- Build excitement

- Reduce your caution

- Push you into fast decisions to lure you in to SCAM.

Rule:

If the rate feels too good to be true, it usually is a scam.

2. Buyer Insists Only on Online Transactions (No Face-to-Face, In-Office Deals)

A buyer who completely avoids face-to-face meetings, even for large amounts, is a risk.

While online deals are common, high-value USDT or any crypto transactions require physical verification, especially in OTC deals.

Scammers hide behind:

- Telegram

- International Whatsapp Number

- Fake LinkedIn profiles

Rule:

For large amounts, a legitimate buyer will not hesitate to meet, verify, and build trust.

3. Asking for Video Calls to Show Your USDT/Crypto Details –

This is a classic scam tactic.

They will ask you to:

- Share wallet balance on screen

- Show transaction history

- Open wallet apps during video calls & steal your private keys.

This information can be used for:

- Social engineering

- Targeted phishing

- Planning wallet drain attacks

Rule:

Never show wallet details, balances, or transaction screens to unknown buyers.

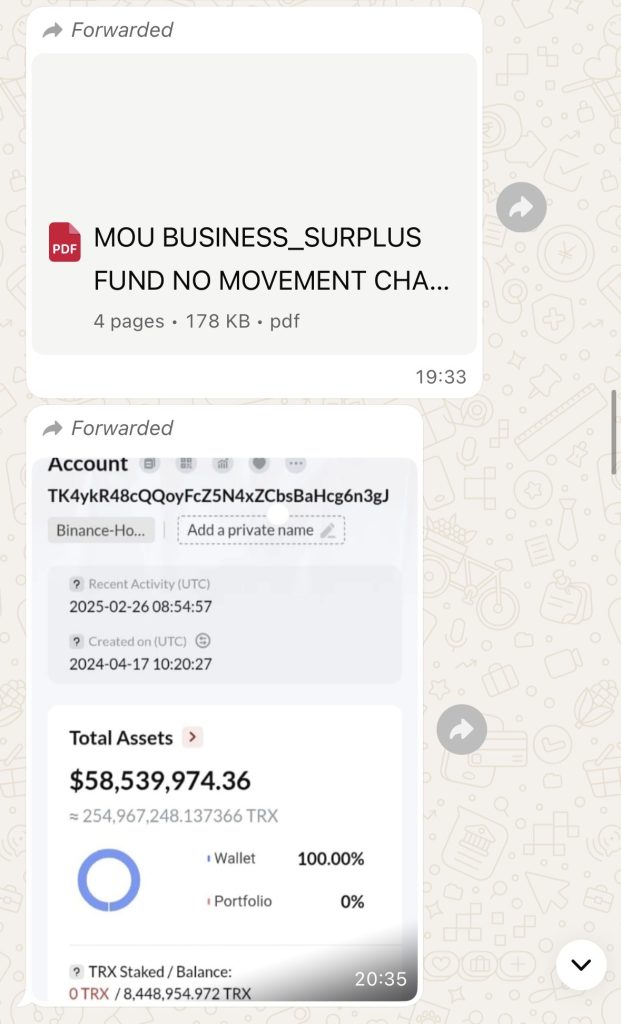

4. No Online Ratings, Reviews, or Track Record

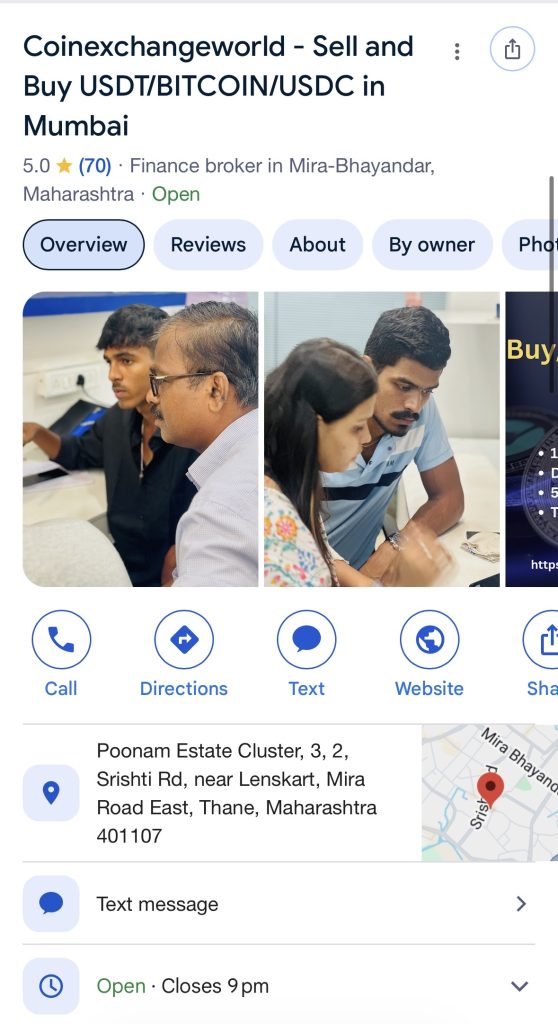

A genuine buyer or desk usually like coinexchangeworld has:

- Google presence

- Website

- Reviews

- Community reputation

If someone claims to handle “huge volumes” but has zero digital footprint, that’s suspicious.

Rule:

No history = no trust.

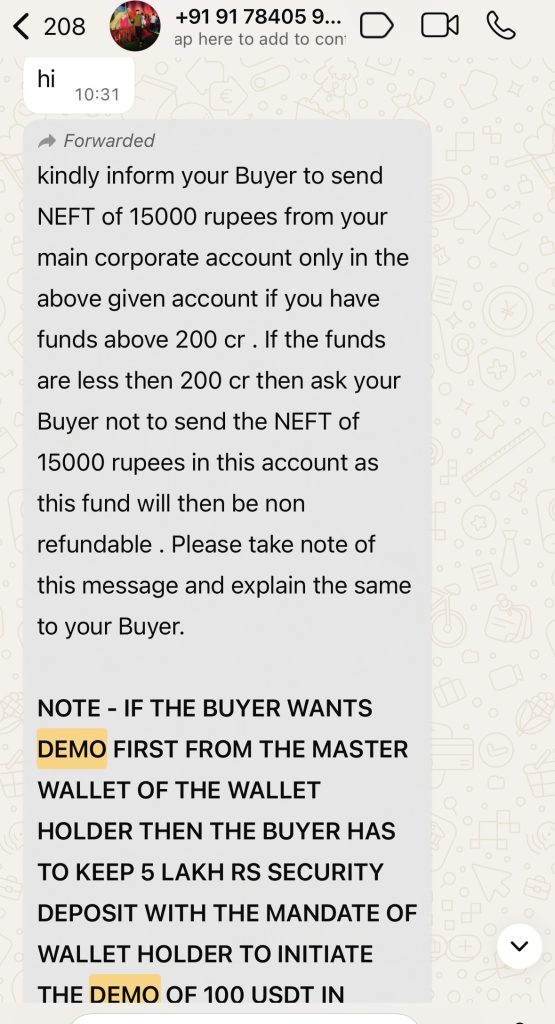

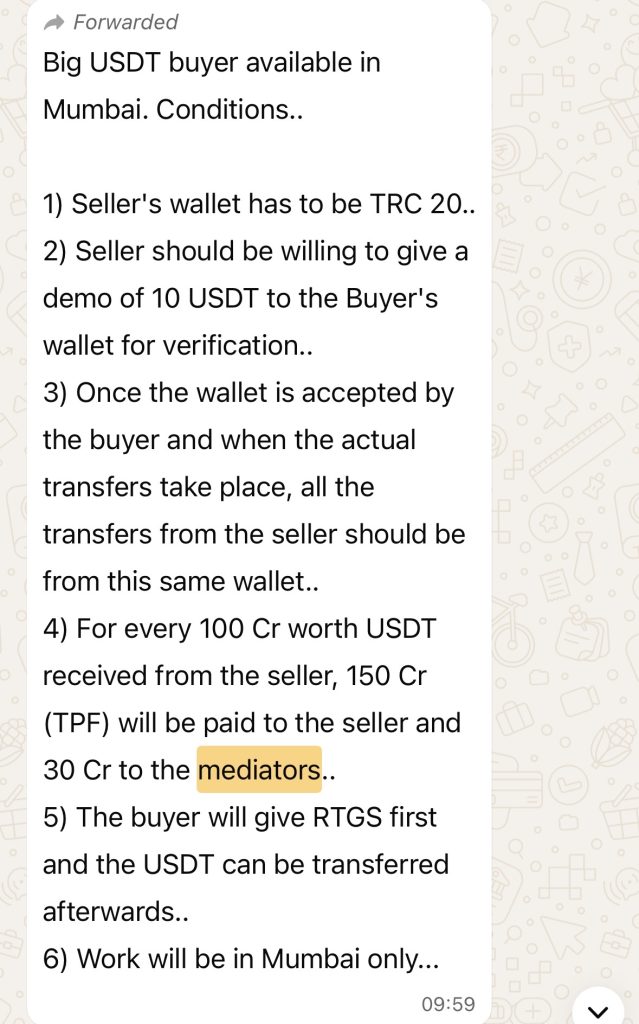

5. Asking for Online Verification or Demo Transactions

Many scammers ask for:

- “Small demo USDT transfer”

- “Verification transaction”

- “Test transaction”

Once you send it, it’s gone forever.

Crypto transactions are irreversible.

Rule:

There is no such thing as a demo transaction in crypto with strangers. Do a demo only on Face to face in-office meet.

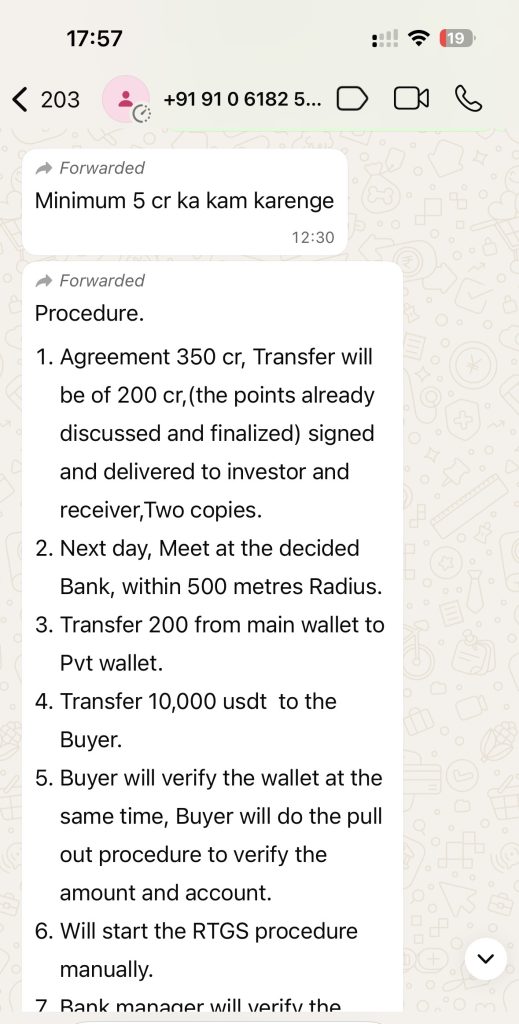

6. Pushing for Extremely High First Transactions (₹50 Lakh – ₹1 Crore)

Legitimate crypto buyers start small to build trust.

Scammers do the opposite:

- Push for very high first deals

- Create urgency

- Claim “client waiting” or “bank limits”

This is done to maximize damage in one shot.

Rule:

Any first transaction should be small and controlled.

7. Asking to Meet in Cafes or 5-Star Hotels & Execute the deal

Meeting in public places like cafes or luxury hotels is not professionalism—it’s camouflage.

Scammers prefer such locations because:

- No proper verification

- No security protocol

- Easy escape

Real Crypto desks operate from:

- Offices

- Registered locations

- Secure environments

Rule:

Luxury location ≠ legitimacy.

8. Presence of Too Many Mediators in the Deal –

If the deal involves:

- Brokers

- Sub-brokers

- “My partner will talk”

- “Client’s client”

It increases:

- Confusion

- Risk

- Accountability loss

Scams thrive in multi-layered communication.

Rule:

The more people involved, the less clarity and more danger.

9. Buyer Has No Technical Knowledge of Crypto –

A genuine USDT buyer understands:

- Blockchain networks (TRC20, ERC20, etc.)

- Gas fees

- Confirmation times

- Wallet security

If someone is clueless but claims to do “daily crore-level deals,” that’s a lie.

Rule:

Ignorance + confidence = scam.

10. Long, Complex Terms & Conditions Documents –

Some scammers use lengthy legal-looking documents to:

- Overwhelm you

- Confuse you

- Shift liability

Crypto deals thrive on clarity, not paperwork overload.

Rule:

If the document is more complex than the transaction itself, step back.

11. Pressure, Urgency & Emotional Manipulation (Hidden but Deadly)

Though not always obvious, scammers:

- Rush you

- Create fear of missing out

- Say “last chance”

- Claim “bank window closing”

Pressure kills rational thinking.

Rule:

Any deal that doesn’t give you time to think is a bad deal.

Final Thought: Safety Is More Valuable Than High Rates

In crypto, capital preservation is success.

One bad USDT deal can:

- Wipe out months of profits

- Create legal issues

- Damage your reputation

Always remember:

It’s better to miss a deal than to lose your USDT or crypto

If you are selling USDT or cryptos in large volumes, work only with:

- Verified Crypto Offices like we do at Coinexchangeworld in Mumbai.

- Trusted partners

- Transparent processes

Greed attracts scams. Discipline avoids them.